When talking about spousal abuse, we normally think of physical violence or verbal intimidation. But my husband exerted control over me by completely hijacking my finances, and it took years to repair the damage.

I squint in the sunlight as I search the grocery store parking lot for my dark SUV. As I walk past a PT Cruiser parked in the same row, I unconsciously press my fingernails into the soft flesh of my palms. I hate PT Cruisers. I hate the oddly curved shape of them, and I really hate the memories they bring up for me.

Those memories, unfortunately, revolve around a past relationship of mine that was defined by “financial abuse.” It’s a term I wasn’t even familiar with at the time, but one that aptly describes the two years I spent being controlled by someone who was using my credit cards and draining my assets for his own personal gain, despite my telling him repeatedly to stop. His manipulation impeded my ability to provide for our child’s most basic needs—needs he had no interest in helping to meet himself—and every month I spent with him dragged our family that much closer towards eviction and made it more difficult for me to leave.

It was a very isolating situation, but I was far from alone. According to the National Network to End Domestic Violence, financial abuse occurs in 99 percent of domestic violence cases, but according to a 2014 study, 78 percent of Americans did not even recognize financial abuse as a form of domestic violence. I am just one of millions of women who have experienced this kind of abuse, but I am also one of the lucky ones who found a way out.

When my ex-husband Dax and I were first married in 2001, we were both 23 and living in Cheyenne, WY. One of our more pressing needs at the time was a reliable car, because we were expecting our first baby and his old, classic Ford didn’t always start. At first, he talked about buying his parents’ Ford Bronco because they had just bought a new truck. That sounded good to me, so I suggested we save a few thousand dollars to give to them as a down payment and then make monthly payments after that. A smart and sensible solution, right? Unfortunately, Dax decided to ignore my advice. Instead, we soon found ourselves at a local car lot looking at brand-new PT Cruisers.

I had agreed to go with him just to look at cars, but I did not anticipate that he would immediately start shopping for something brand new. Personally, I had never even bought a car before, and I had no idea what kind of financial obligations went with that sort of purchase. Dax swore he would be able to sell his old car easily after finding something new, and with that money, the new car payments would be taken care of. But still, I was very nervous whenI saw the prices written on the windows of the cars he was talking to the salesman about. We were both working at the time, but he was still in the probationary period of his new sales job, and he could (and would) be let go if he did not sell a certain amount for his new company. We didn’t have any savings or an emergency fund. But we did have a baby due in a matter of months. Sadly, none of that slowed him down. Before I knew it, we were in the salesman’s office with Dax intending to purchase the second-most-expensive PT Cruiser they had. He got on my cellphone and began making calls to find money to borrow for the down payment. I sat there, silently hoping that he would fail. In the end, however, he decided to split the down payment of $4,000 between my three credit cards, and I reluctantly agreed.

I had signed up for a few credit cards in college, used my cards very rarely, and always paid them off in full, immediately. I had no idea that paying to register Dax’s car and carrying full-coverage insurance for him myself would dig such a deep financial hole for me—and me alone. After we made the purchase, his old car took several months to sell, and by then, Dax had been laid-off for not making the sales quota he needed, while I was out on maternity leave.

After Dax used my cards to buy his car, we had to make interest payments, plus pay the $455-a-month car payment, maintain expensive insurance since the car was brand new, and still have money to live on. But the high balances and skyrocketing interest did not deter him. Neither did my telling him over and over how much it would ultimately cost since we could only afford the minimum payments. By this time, I sorely regretted combining our checking accounts and putting his name on one of my credit cards to use for household purchases. My parents and grandparents were my financial role models and they all had joint accounts, but none of them were financially irresponsible and I did not know the warning signs of financial abuse. I just thought combining finances is what married people did.

I made payments and he kept swiping the little plastic card. I kept working and he was often unemployed. Our debt kept growing and no matter how little money was coming in, he kept up the same level of spending, swipe after swipe. Whenever my credit card statements and bank balances arrived, it was always a surprise to see how many transactions for bottles of Mountain Dew and clove cigarettes one unemployed man could make knowing the rent or electric bill was due. But my objections fell on deaf ears.

The rest of my short marriage was similarly financially catastrophic. I stressed about money all the time, and my stomach always hurt. I prioritized paying rent and buying diapers and groceries, and I repeatedly hid my credit cards. But Dax would always find them. It didn’t matter whether his name had been added to the account or if mine was the only one, he would use them, saying that he should have access to any money I earned because we were married. Meanwhile, he sat at home playing video games while I worked, and his parents babysat our son. My husband did not care about keeping a roof over our heads, so I wrote out the rent check, electric bill, made minimum payments on the cards, and then hid the checkbook, forcing him to borrow money from his parents to make payments on his car.

I suffered and went without so much while trying to provide for my son. Meanwhile, I drove an old Pontiac with a broken heater that my parents let me use because I couldn’t even drive that horrible PT Cruiser. Some complications from my pregnancy kept me from being physically able to use the Cruiser’s stick shift. And when I was finally able to use my right arm again, I had to start learning to drive a stick from scratch. It didn’t matter that my name was on the car, or that I earned most of the money to pay for it, or that I also bought the gas. Dax had bought it for himself.

After about two-and-a-half years of marriage, I couldn’t handle the stress any longer. It was humiliating having to borrow money from my teenage sister who was in college and working as a waitress for the summer just to buy diapers. She didn’t bat an eye as she counted out some of her tip money to buy whatever her nephew needed, but I felt like crap about my choice of husband and that I couldn’t afford everything for my child on my own.

“Bad relationships rarely start out that way, and each woman has to get to her breaking point where she realizes she has had enough”

Bad relationships rarely start out that way, and each woman has to get to her breaking point where she realizes she has had enough. I got tired of the promises Dax never intended to keep and I could no longer endure constantly yelling at him to stop spending money we didn’t have or begging him to actually work, since he had gone through 10 jobs in less than 3 years. By the time I kicked Dax out of our apartment in the summer of 2003, my finances were a disaster and it took years to clean up the mess. The credit card companies came after me even though I had called Visa and Discover and told them my husband was using my cards without my permission. Since my name was on the accounts, I was held responsible for hundreds of Dax’s purchases, even without my signature. Eventually, however, when I went to court to fight for custody of our son, the judge ruled in my favor and Dax was finally ordered to take responsibility for the debt he had created. I walked out thinking everything would get better. But that was not the end.

Dax did not take my name off the car, and then the PT Cruiser was repossessed after he got fired from another job. He did not pay the credit card debt he had been ordered to resolve, opting instead to file for bankruptcy. I went to the bankruptcy hearing and witnessed him squirming out of his obligations. Again. Meanwhile, I was the one who the credit card companies and the dealership still came after for the debts he’d incurred. He didn’t pay child support, and because he’d managed to take his name off the phone accounts he’d purchased before the spilt, my own phone was shut off twice for non-payment. I felt like I was drowning.

When I went to Dax’s bankruptcy hearing armed with the legal decision from our divorce hearing, the judge granted him the bankruptcy and said nothing about what he owed me, as if I was not even there. I called creditor after creditor, but his bankruptcy was a get-out-of-jail-free card. The credit card companies didn’t care about the paperwork I offered to send them proving that Dax had been ordered to pay for what he had charged. It didn’t matter to them that his name was not even on two of my accounts that he had maxed out. But I simply couldn’t pay down those bills or pay for the PT Cruiser that had eventually been repossessed. I was paying for rent and daycare and buying groceries. After those bills were taken care of, I had student loans and my own car payments I had to make to my dad for a used car he’d bought me. After those expenses, my paycheck was completely spent.

I got calls and bills and past due notices from creditors because I did not file for bankruptcy like Dax did. Eventually, I started paying the bills I was assigned and made monthly payments to my lawyer. Several years later, I was rewarded for my responsibility with a new “secured card” with a $200 limit that allowed me to build up my credit again as long as I paid right away. I also inherited very high interest rates on any car loan I may want to take out in the future because the repossession of that PT Cruiser left a black mark on my credit. Our marriage lasted less than three years, but the financial abuse my husband inflicted upon me impacted my life for about a decade.

Ultimately, I did learn my lesson. And when I remarried in 2014, I chose a spouse with a Warren Buffett-level credit score who is helping me to get mine higher as well. I was able to build up my savings account and pay off all the debt Dax left me with, along with my student loans and my last new car. My credit cards have decent limits again, and my most recent car loan had an amazingly low interest rate. Most of all, though, I now know for sure that I can recognize a financial abuser, and I can say confidently that I have survived.

If you or someone you love is struggling with a financially abusive relationship, you’re not alone. Here are some resources to help you get free:

A network of over 200 social services agencies across America that can help users meet basic housing, food, transportation, and health care needs during times of crisis.

Find affordable mental-health treatment wherever you live with this growing list of providers committed to financial accessibility.

Free legal information and resources for victims of abuse.

NNEDV.org/resources-library/financial-abuse-toolkit/

Resources for escaping a financially abusive relationship, tips for regaining financial independence, links to social services, and more, from the National Network to End Domestic Violence.

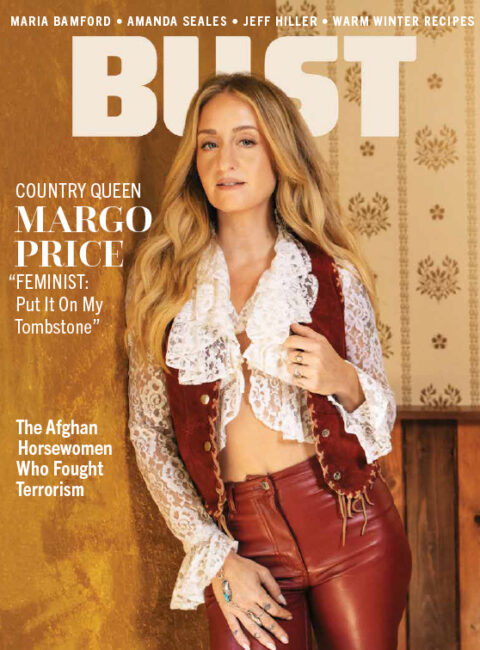

This article originally appeared in BUST Summer 2022 print issue.

Top Image: Illustration by Lauren Wilcox

—Carly Trudel